portability estate tax deadline

The portability election is made on an estate tax return filed within 9 months of death unless a timely extension is filed for the estate. Berlin Many owners should breathe a sigh of relief at this news.

Services John F Ortolf Cfp Chfc Doylestown Pa Wells Fargo Advisors

To appeal your propertys.

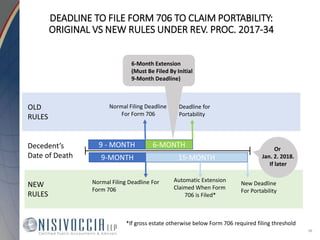

. But what if you miss the portability filing deadline. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 exempts from federal estate tax the first 5 million of a decedents taxable estate. Under prior Revenue Procedure 2017-34 estates of decedents with a surviving spouse not required to file a federal estate tax return had up to two 2 years after the.

10 hours agoThe second rebate is on property taxes equal to the property tax credit claimed on 2021 Illinois taxes up to 300 according to the state Department of Revenue. However over time the taxing agency found itself managing a large number of requests for private letter. The submission deadline for the property tax return is to be extended.

To secure the portability of the first spouses unused exemption the estate executor must file an estate tax return even if the estate is exempt from filing a return because. The IRS had previously extended the deadline to file for portability to two years. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

It is important to note however that for Maryland which has a state-level estate tax and its own portability rules the state filing deadline for state-level portability remains. On July 8 2022 the IRS issued Revenue. Is there a late portability election.

Aside from increasing the estate tax gift tax and generation-skipping transfer tax exemptions to 5000000 for 2011 and 5120000 for 2012 this law introduced the concept of. We will begin paying ANCHOR benefits in the late Spring of 2023. IRS Extends Deadline to File Estate Tax Returns for Portability.

The IRS extended the deadline to elect portability for estates not required to file estate tax returns to two years after the decedents death in Rev. However the IRS quickly discovered that many estates were still missing the deadline even with the extended deadline. New Estate Tax Portability Election Relief.

The IRS issued a revenue procedure Rev. The estate tax return Form 706 must be filed within five years of the death of the spouse. Portability must be elected by the executor after the death of the first spouse.

Residents may call their County Tax Board for more information. 2022-32 may seek relief under Regulations section. IRS expands portability of a 2412 million estate tax exemption but things may change dramatically in 2026.

The IRS recently released an update to its federal estate tax regulations relaxing the rules on making a late portability election to a descendants estate. Your taxes could go. 2022-32 Friday that allows estates to elect portability of a deceased spousal unused exclusion DSUE amount as much as five years.

On Tuesday the council will be asked to approve a measure extending the new tax deadline to June 10 and implementing a 40-day. ANCHOR payments will be paid. In this post we will address the available options when an estate executor misses the.

Effective July 8 2022 the Department. 22 hours agoThe deadline is now to be extended. The estate tax return is due nine months after the decedents.

The deadline for filing your ANCHOR benefit application is December 30 2022. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev.

Portability Enabled Traditional Trusts Clark Trevithick Full Service Boutique Law Firm In Los Angeles California Southern California

The Irs S New Portability Rule And The Estate Tax Financial Planning

Attorney At Law It S Not Too Late To Elect Portability Tbr News Media

Estate Tax Portability Election Extended Virginia Cpa

Nj Estate And Inheritance Tax 2017

Form 706 Extension For Portability Under Rev Proc 2017 34

Relief From Irs Portability Of Lifetime Tax Exemption Extended Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

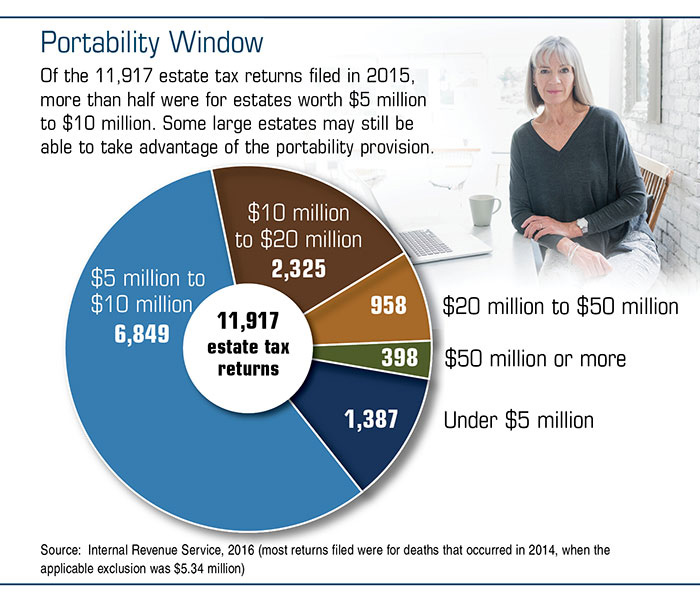

Exploring The Estate Tax Part 1 Journal Of Accountancy

Exploring The Estate Tax Part 1 Journal Of Accountancy

Trusts And Estates Chapter 4 Pp Ppt Download

Deadline Near To Make Very Late Portability Elections Henry Horne

What Spouses Need To Know About Portability Of The Estate Tax Exemption

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

The Wealthy Now Have More Time To Avoid Estate Taxes

Don T Forget About Making A Portability Election Capell Howard P C Attorneys At Law

Portability Of The Estate Tax Exemption Cdh Law Pllc

Irs Issues Revised Revenue Procedure For Late Portability Elections

Great News For Those Missed The Portability Filing Deadline Karp Law Firm

Power Of Portability This Estate Tax Tool Can Save You Millions Agweb