marin county property tax calculator

The assessor will determine if the transaction qualifies and provide you with claim forms. Taxing units include city county governments and various special districts such as public schools.

Transfer Tax In Marin County California Who Pays What

Secured property tax bills are mailed only once in October.

. California Property Tax Calculator. This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. Marin County COVID-19 Status Update for April 29 includes property.

The median property tax on a 15070000 house is 146179 in Florida. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. Martin County Property Appraiser.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. YES HomesteadPortability NO Non. Secured property taxes are payable in two 2 installments which are due November 1 and February 1.

The information provided above regarding approximate insurance approximate taxes and the approximate total monthly payment collectively referred to as approximate loan cost illustration are only. Total ValueSales Price of Property. The median property tax on a 15070000 house is 129602 in Marion County.

Tax Rate Book 2012-2013. Method to calculate Marin County sales tax in 2021. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

Marin county has one of the highest median property taxes in the united states and is ranked 26th of the 3143 counties in order of median property taxes. Marin County Home Property Tax Statistics. San Rafael California 94903.

This calculator will also compute your total mortgage payment which will include your property tax property insurance and PMI payments. Deed in Lieu of Foreclosure Only. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

3501 Civic Center Drive Suite 208. Marin county collects on average. Offered by County of Marin California.

The median property tax on a 86800000 house is 642320 in California. Marin County California Mortgage Calculator. How was your experience with papergov.

Property Tax Estimator Will you be getting homestead. Property Tax Bill Information and Due Dates. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Establishing tax levies estimating property worth and then receiving the tax. The median property tax on a 15070000 house is 158235 in the United States. The median property tax on a 86800000 house is 546840 in Marin County.

352 368-8200 In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Please call for questions. Unsure Of The Value Of Your Property.

The supplemental tax bill is in addition to the annual tax bill. Penalties apply if the installments are not paid by. Tax Rate Book 2015-2016.

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Find Marin County Home Values Property Tax Payments Annual Property Tax Collections Total and Housing Characteristics. Marin County Assessor Marin County Assessor.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. This is equal to the median property tax paid as a percentage of the median home value in your county. Property Tax Appraisals The Marin County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and.

The average sales tax rate in California is 8551. See detailed property tax information from the sample report for 123 Park St Marin County CA. The purpose of this Supplemental Tax Estimator is to assist the taxpayer in planning for hisher supplemental taxes while waiting for their.

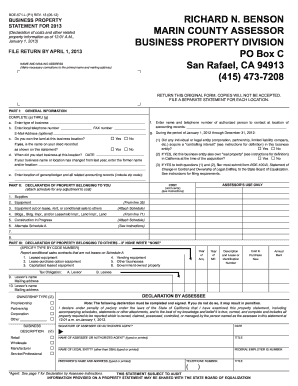

Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes. Below is a picture of the Declaration of Value Form. Ad Get In-Depth Property Tax Data In Minutes.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. Find All The Record Information You Need Here. 3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608.

They all are legal governing units managed by elected or appointed officers. The median property tax on a 86800000 house is 642320 in california. Ad Property Taxes Info.

Present this offer when you apply for a mortgage. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Tax Rate Book 2014-2015.

The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Main Office McPherson Complex 503 SE 25th Avenue Ocala Florida 34471 Phone.

In our calculator we take your home value and multiply that by your countys effective property tax rate. The median property tax on a 86800000 house is 911400 in the United States. Real Property Searches.

Search Valuable Data On A Property. Choose RK Mortgage Group for your new mortgage. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Overall there are three stages to real estate taxation. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Tax Rate Book 2016-2017.

The average sales tax rate in California is 8551. We have highlighted the appropriate line items to complete as well as provided the appropriate numbers for each line below. Such As Deeds Liens Property Tax More.

At that rate the total property tax on a home worth 200000 would be 1620. Method to calculate Marin City sales tax in 2021. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate.

Start Your Homeowner Search Today. Tax Rate Book 2013-2014.

Marin Economic Forum Mef Blog Marin Economic Forum

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Form 571 L Marin County Fill Out And Sign Printable Pdf Template Signnow

Marin Economic Forum Mef Blog Marin Economic Forum

Marin County California Property Taxes 2022

Marin County California Fha Va And Usda Loan Information

Transfer Tax In Marin County California Who Pays What

Marin Residents Have Until Monday To Pay Property Taxes

Transfer Tax In Marin County California Who Pays What

Covid 19 Renter Protections Community Development Agency County Of Marin

Marin County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Marin Wildfire Prevention Authority Measure C Myparceltax

Current Sewer Service Charges Novato Sanitary District

Marin Wildfire Prevention Authority Measure C Myparceltax

Top Restaurants In Marin County San Francisco

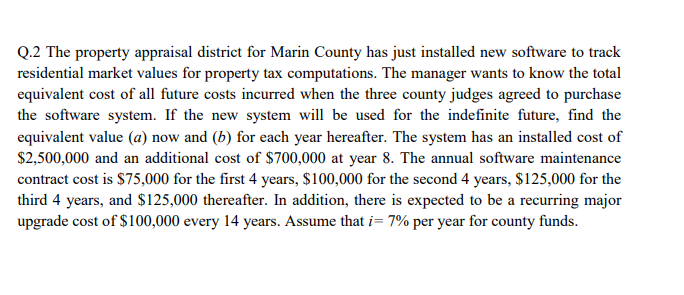

Solved Q 2 The Property Appraisal District For Marin County Chegg Com

Job Opportunities Career Opportunities At Marin County Superior Court